RBI which is esteemed institution in India recruits RBI Grade B Officer every year via common recruitment exam. Many candidates in the country prepare for this exam, as this gives them excellent career opportunity for life. In this page we have given all the necessary information about the RBI B grade officer post and its recruitment exam which every job aspirant as well as graduate students needs to know.

What is the RBI Grade B Officer Job Profile ?

The Job of RBI Grade B Officer is not just a career but it also a commitment to serve the country. While serving as an Officer in apex institution your decisions and approach make an impact on the financial and economical growth of the country.

The Job of RBI Grade B Officer is not just a career but it also a commitment to serve the country. While serving as an Officer in apex institution your decisions and approach make an impact on the financial and economical growth of the country.

RBI is a Fully services financial Organisation which is handling range of functions. A very exciting job roles are handled by RBI Grade B Officers in this Central Bank.

To work as a RBI Grade B officer with central bank is a matter of high prestige in society.

RBI B Grade Officer have to inspect the credit appraisal system of retail banks which lends money to the public.

RBI B Grade Officers have to check whether the retail banks are following the guidelines of KYC AML (Know Your Customer, Anti Money Laundering ) or not. If retail banks not follows the guidelines the Officers penalise those banks.

RBI B Grade officer also have to inspect the cash vault functioning and overall security of every branch because there is a public money involved and the security of public money is one of the mission on RBI. They have to make sure that all the banks in the country are functioning as per the Banking Regulation Act 1949

The RbI B Grade Officers manages the accounts of the government and the central banks. In this post there is no public dealing unlike the officers in public sector bank.

RBI recruits The B grade officer post in 3 category viz. B grade General, B grade DEPR ( Department of Economic and policy research ), B grade DSIM ( Department of Statistics and Information Management )

A candidate have to select one from these 3 categories while applying for the Officers post.

RBI has about 30 departments and according to the category selected by the candidates they are posted in the department.

Some of RBI departments where the RBI B Grade officers will be posted is as follows

- Foreign Exchange department

- Public Debt Office

- Department of Banking Supervision

- Department of Non Banking Supervision

- Department of Cooperative Banking Supervision

- Department of Banking Regulation

- Department of Economic Policy Research

- Monetary Policy Department

- Department of Currency Management

- Financial Markets Operation Department

- Department of External Investment and Operations.

- Financial Inclusion & Development Dept.

- Risk Management Dept.

- Dept of Statistics & Information Management.

- Banking Ombudsman.

- Consumer Education & Protection Dept

So from above list of department you can assume how exciting, thrilling, compelling and important is Job of RBI B Grade Officer.

Who can Apply for RBI Grade B Officer Post ?

Eligibility Criteria of RBI Grade B Officer is as Follows

Eligibility Criteria of RBI Grade B Officer is as Follows

Nationality :

A Citizen of India or a Subject of Nepal, Bhutan or a Tibetan refugee who came to India before 01/01/1962 with the intention of settling in India.

Age Limit :

A minimum age of candidate for applying for the post is 21 years and maximum age is 30 years.

The Upper age limit is relaxed in certain condition as follows :

- Upto 5 years for the candidate belonging to SC/ST category.

- Upto 3 years for the candidates belonging to OBC category.

- Upto 5 years for ex-servicemen.

- Upto 15 years for PwBT(SC/ST), 13 years for PwBT(OBC), 10 years PwDT (Gen.)

- For candidates having M.Phil. and Ph.D. qualification, the upper age limit will be 32 and 34 years respectively.

- For candidates having experience in Scheduled Commercial Bank the Upper age limit is 33 years.

Education Qualification :

For B Grade Officer (General) :- Any Graduation with minimum of 60 % aggregate marks for general and 50 % marks for others OR PG in any discipline with 55 % marks for general and pass class for others.

For B Grade Officer (DEPR) :- Masters Degree in Economics OR Masters Degree in Finance with 55 % aggregate marks.

For B Grade Officer (DSIM) :- Masters Degree in Statistics/ Econometrics. OR Masters Degree in Mathematics with one year PG Diploma in Statistics OR M.Stat Degree of Indian Statistical Institute OR PG Diploma in Business Analytics offered by ISI Kolkata, IIT Kharagpur, IIM Calcutta with minimum of 55 % aggregate marks.

Note : A General Candidate can Apply maximum of 6 times for the post of RBI B Grade Officer.

How to Apply for the RBI Grade B Officer Exam ?

The only method for Applying to the post is Online method. No other mode of application is accepted from the RBI for the post.

The only method for Applying to the post is Online method. No other mode of application is accepted from the RBI for the post.

RBI Publish the Advertisement for the RBI Grade Officer post in various platform like employment news and Current vacancies section of RBI website.

While Applying for the post, a candidate should be ready with all related information like identity proof , address proof and academic information etc.

A candidate have to scan his/her signature and photograph before applying because they have to be uploaded while applying to the post.

After the completion of the filling of details the candidate have to submit the application and then it will redirect to payment page where candidate have to pay a fee via online method for example by net banking or by debit card.

Salary, Benefits and Career Prospects of RBI Grade B Officer.

Salary and benefits of RBI B Grade Officer is at par in the industry beside the social respect in banking community is very high.

Salary and benefits of RBI B Grade Officer is at par in the industry beside the social respect in banking community is very high.

The pay scale of RBI B Grade officer is Rs 35,150 – 62,400/- I.e the basic payment of newly recruited RBI officer is 35150/- plus other allowances like DA, LA, HRA, FA and grade allowances which are revised time to time. After adding all allowances the monthly gross payment is near about Rs 84,000/- per month.

Accommodation is provided to the RBI Officers in Officers quarters. If accommodation is not provided by the bank then 15% HRA is given to the officers.

The other Benefits of RBI B Grade Officers include Free medical facilities for self and dependent family person. Interest free festival advance, Leave Fare Concession once in two year. Loans at concessional rates of interest for Housing, Education, Consumer Appliances. The Officers will be benefited by the New Pension Scheme.

RBI B Grade Officer post gives the immense opportunity to individual to uplift in career. They can be promoted upto a Deputy Governor of RBI. There is regular promotional exams and assessment of the officers in RBI.

Syllabus of RBI B Grade Officer Exam

The RBI Grade B Officers ( General ) Exam is conducted in 3 Phase .

The RBI Grade B Officers ( General ) Exam is conducted in 3 Phase .

(1) First phase is Objective type online examination which is of 200 marks. This paper consist of 4 subjects which are

- General Awareness

- English Language.

- Quantitative Aptitude and

- Reasoning.

The total time allowed for solving exam is 120 minutes. A separate time is allotted for each subject.

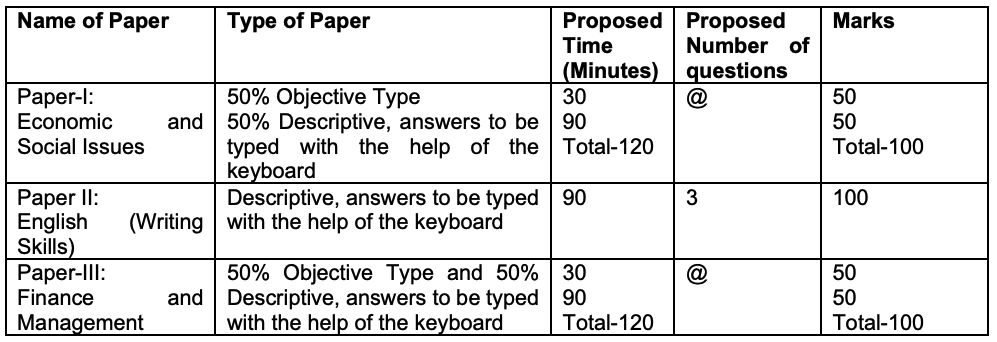

(2) Second Phase of Paper is Objective as well as Descriptive type and can only appeared by those candidate who successfully cleared the first phase of the exam.

In Second Phase of Exam there are 3 Papers

- Economic and Social Issues

- English ( Writing Skills)

- Finance and Management

In paper 1 and paper 3 there will be 30 questions for 50 marks in Objective section and in Descriptive section 6 questions will be asked out of which a candidate have to answer 4 questions from which 2 questions are for 15 marks and 2 questions are for 10 marks.

All the question paper except English and set in English and Hindi language.

- Growth and Development – Measurement of growth: National Income and per capita income – Poverty Alleviation and Employment Generation in India – Sustainable Development and Environmental issues.

- Indian Economy – Economic History of India – Changes in Industrial and Labour Policy, Monetary and Fiscal Policy since reforms of 1991 – Priorities and recommendations of Economic Survey and Union Budget – Indian Money and Financial Markets: Linkages with the economy – Role of Indian banks and Reserve Bank in the development process – Public Finance – Political Economy – Industrial Developments in India- Indian Agriculture – Services sector in India.

- Globalisation – Opening up of the Indian Economy – Balance of Payments, Export-Import Policy – International Economic Institutions – IMF and World Bank – WTO – Regional Economic Cooperation; International Economic Issues.

- Social Structure in India – Multiculturalism – Demographic Trends – Urbanisation and Migration – Gender Issues – Social Justice: Positive Discrimination in favour of the under privileged – Social Movements –– Indian Political System – Human Development – Social Sectors in India, Health and Education.

- Financial System :

1. Regulators of Banks and Financial Institutions

2. Reserve Bank of India- functions and conduct of monetary policy

3. Banking System in India – Structure and concerns, Financial Institutions – SIDBI, EXIM Bank, NABARD, NHB, etc, Changing landscape of banking sector.

4. Impact of the Global Financial Crisis of 2007-08 and the Indian response

- Financial Markets

Primary and Secondary Markets (Forex, Money, Bond, Equity, etc.), functions, instruments, recent developments.

- General Topics

1. Risk Management in Banking Sector

2. Basics of Derivatives

3. Global financial markets and International Banking – broad trends and latest developments.

4. Financial Inclusion

5. Alternate source of finance, private and social cost-benefit, Public-Private Partnership

6. Corporate Governance in Banking Sector, role of e-governance in addressing issues of corruption and inefficiency in the government sector.

7. The Union Budget – Concepts, approach and broad trends

8. Inflation: Definition, trends, estimates, consequences, and remedies (control): WPI, CPI – components and trends; striking a balance between inflation and growth through monetary and fiscal policies.

9. FinTech

- Management

Fundamentals of Management & Organisational Behaviour: Introduction to management; Evolution of management thought: Scientific, Administrative, Human Relations and Systems approach to management; Management functions and Managerial roles; Nudge theory Meaning & concept of organizational behaviour; Personality: meaning, factors affecting personality, Big five model of personality; concept of reinforcement; Perception: concept, perceptual errors. Motivation: Concept, importance, Content theories (Maslow’s need theory, Alderfers’ ERG theory, McCllelands’ theory of needs, Herzberg’s two factor theory) & Process theories (Adams equity theory, Vrooms expectancy theory). Leadership: Concept, Theories (Trait, Behavioural, Contingency, Charismatic, Transactional and Transformational Leadership; Emotional Intelligence: Concept, Importance, Dimensions. Analysis of Interpersonal Relationship: Transactional Analysis, Johari Window; Conflict: Concept, Sources, Types, Management of Conflict; Organisational Change: Concept, Kurt Lewin Theory of Change; Organisational Development (OD): Organisational Change, Strategies for Change, Theories of Planned Change (Lewin’s change model, Action research model, Positive model).

- • Ethics at the Workplace and Corporate Governance

Meaning of ethics, why ethical problems occur in business. Theories of ethics: Utilitarianism: weighing social cost and benefits, Rights and duties, Justice and fairness, ethics of care, integrating utility, rights, justice and caring, An alternative to moral principles: virtue ethics, teleological theories, egoism theory, relativism theory, Moral issues in business: Ethics in Compliance, Finance, Human Resources, Marketing, etc. Ethical Principles in Business: introduction, Organization Structure and Ethics, Role of Board of Directors, Best Practices in Ethics Programme, Code of Ethics, Code of Conduct, etc. Corporate Governance: Factors affecting Corporate Governance; Mechanisms of Corporate Governance Communication: Steps in the Communication Process; Communication Channels; Oral versus Written Communication; Verbal versus non-verbal Communication; upward, downward and lateral communication; Barriers to Communication, Role of Information Technology.

Third phase of exam is Interview which carries 75 marks. In interview the knowledge of candidate has been checked is respect of banking and finance. The confidence and approach of candidate has also been assessed and according to this marks in the interview is given.

FAQs

The syllabus of RBI Grade B Officer exam is very vast and related to commerce subject. Hence the Commerce student have an advantage to getting success in first attempt of exam, if they prepare for exam with proper plan.

If you see the syllabus of RBI Grade B officer exam you will notice that mainly commerce related subjects are included in it. Hence Commerce Degree is best for this exam as they already get prepared for this.

If a candidate reached upto the interview of the RBI Grade B Officer exam that means he/she have studied well enough and have all sufficient knowledge of banking and commerce. So the candidate only have to work on personality while attending interview of this exam.

Yes, RBI B Grade Officer is fully comes under government of India and it is a government job.